Walking The Walk

While continuing to grow the new, expanded Central Pacific Bank, Clint Arnoldus takes time out to chair Saturday’s WalkAmerica

By .(JavaScript must be enabled to view this email address)

E-mail this story | Print this page | Archive | RSS |

Del.icio.us

Del.icio.usThe best way to lengthen out our days is to walk steadily and with a purpose. — Charles Dickens

On Saturday, Clint Arnoldus will step up for charity and lead 4,000 Hawaii walkers in March of Dimes’ WalkAmerica, the country’s largest and most successful charity walk. Funds raised help prevent premature births and birth defects.

There’s another walk that Arnoldus makes every day in the business world. It’s keeping Central Pacific Bank a step ahead of the competition and keeping pace with consumers’financial needs. Now that he’s led the merger of City Bank and Central Pacific Bank, can he take the combined forces to the next level of greatness? Can he be the champion of community banking in Hawaii? Is Clint Arnoldus walking the walk, both in the community and in business?

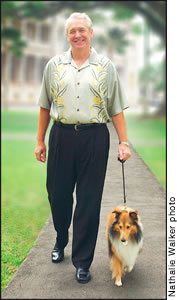

Clint Arnoldus prepares for Saturday’s

WalkAmerica with Alex,

CPB’s ‘loyalty officer’

We took a stroll to CPB’s South King Street headquarters to find out.

Arnoldus was named by the Honolulu Star-Bulletin in 2002 as one of Top 10 Who Made a Difference. We wanted to walk in his shoes and see what keeps him apace in the post-merger era of Central Pacific Bank. First he talked about next week’s charity walk.

Stride with pride. “I was honored when the March of Dimes asked me to be chairman of the walk,” Arnoldus says. “This is a major fundraiser and the most successful walk in town in terms of revenue generated. One in seven births in Hawaii is premature. What could be more needy than a baby that’s born prematurely? That’s as helpless a form of life as we can find.

“March of Dimes is a very impressive organization. It is well-run. Money goes to research, and Hawaii’s goal is $400,000. We need everyone on Oahu to join WalkAmerica.” We need everyone on Oahu to join WalkAmerica.”

It’s easy to participate. Call 973-2155, visit www.walkamerica.org or drop by any branch of Central Pacific Bank.

Five hundred bank employees will join their boss in the charity event. The fivemile walk is Saturday at 7:30 a.m. from Kapiolani Bandstand. And yes, Alex, the bank’s mascot, will be there. When one is “fiercely loyal,” showing up for a good cause is second nature.

“Alex is our biggest draw,” Arnoldus says of the bank’s Shetland sheepdog. “The fiercely loyal banking that the dog represents is something that really exists in the bank. We were able to marry an icon to a perception that the community already had of the bank.”

But is perception reality? Two months after the City Bank signs came down and the teal benches disappeared, is there harmony at the fourth-largest bank in town? Are those newly married bank employees walking a tightrope or walking on air? We

ask Arnoldus about the post-merger transition and the future of community banking in Hawaii.

Big shoes to fill. Three years ago, few might have wanted to be in Arnoldus’shoes. The newcomer arrived at Central Pacific Bank in a “delicate transition” to succeed longtime CEO Joichi Saito. Arnoldus was the first non-Japanese in the bank’s 48- year history. The turn-around expert was brought in to expand the bank’s customer base that traditionally served the financial needs of Japanese-Americans.

A frequent visitor to the islands, Arnoldus planned to retire here someday. With the bank job opportunity, it moved up the timeframe for a permanent move to Hawaii.

“We really liked the feel of Hawaii and the people whom we came in contact with. We wanted to have Hawaii as a gathering place for our family. When I learned out of the blue that this bank was looking for a CEO, it was obviously very intriguing,” Arnoldus recalls.

Soon after becoming chairman, chief executive officer and president of CPB — a “hidden gem” — he began an aggressive investor relations program that resulted in parent company CPB Inc.’s stock more than doubling in 2002, despite one of the worst stock market downturns in history.

That year the bank surpassed $2 billion in assets for the first time. CPB Inc. also switched to the New York Stock Exchange from the NASDAQ Stock Market, and saw its stock have a banner year as it soared 86.7 percent to outperform all other Hawaii companies.

It was a solid foundation on which to build a viable community bank, but in order to compete for market share, more was needed in the way of core products, competencies and assets. Earlier dialogue about a merger of CPB and City Bank (CB) began to surface again. But what was to follow was anything but a walk in the park.

Stepping lively. As we can recall, CPB ran into fierce resistance from CB. There were arguments against the merger at street rallies and in full-page newspaper ads, specifically addressing the CPB chairman. “Mr. Arnoldus, Please Leave Our Company Alone” heralded the headlines.

“We knew that merging these banks would be a very good thing, so we never took our eyes off of that,”Arnoldus says. “We knew that any short-term discomfort was just that. It was something that would go away once the merger took place.

“If you have confidence in who you are and you have certain principles and ethics that you live by, you know people will see that. You know the truth will come out in the end and prevail,” he says philosophically.

Page 1 of 2 pages for this story 1 2 >

E-mail this story | Print this page | Comments (0) | Archive | RSS

Most Recent Comment(s):

Commenting is not available in this weblog entry.